does cash app report to irs for personal use

For a more complete discussion of accounting periods and methods see Pub. IRS2Go App Review Useful Free App for Tax Season Find.

Is The Cash App Safe For Tax Returns As Com

The IRS has put a question about cryptocurrency holdings on page one of 2020 tax returns that taxpayers are expected to answer accurately.

. Find the top reporters on AI NFTs VR AR VC and much more Weve analyzed Techmemes news crawl data to identify the most influential writers on 46 topics. REVENUE PROCEDURE 2000-22 ALLOWS ANY COMPANY sole proprietorship partnership S or C corporationthat meets the sales. Cash App also offers phone-based support at 1-800-969-1940.

The Internal Revenue Service is a proud partner with the National Center for Missing. Instead it only. Meanwhile Squares Cash App updates its policy by opening business accounts for its users.

If you had income from crypto whether due to selling. Top Things To Remember When Filing Your Taxes for 2021 Using the IRS2Go app filers can check their refund status make a. Keep detailed records of your own to compare to the information you receive on Form 1099-K.

The IRS2Go app is the Internal Revenue Services official app. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. Reporting a tax cheater could reward you with more than just the satisfaction of seeing justice done it could make you eligible for a cash reward.

On it the company notes this new 600 reporting requirement does not apply to personal Cash App. But calling the automated hotline may help get you the information you need to submit a report. What the auditors are trying to determine is if.

Open separate P2P accounts for business and personal use to make reporting easier. The personal representative must choose the accounting method cash accrual or other to report the estates income. Turn your Airtable into a powerful custom app no code required Softr is a no-code app builder that lets you create client portals custom CRMs and internal tools powered by your Airtable data.

Once a method is used it ordinarily cant be changed without IRS approval. If you require help using Cash App Taxes you will need to visit the Cash App Taxes site which has an FAQ page. For help from the NHTRC call the National Human Trafficking.

This new rule does not apply to payments received for personal expenses The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such as Venmo Cash App or Zelle will now be reported to the IRS. In this procedure the IRS compares sources of cash on the left and cash expenditures on the right which on paper looks a lot like budgeting. The Internal Revenue Service is a proud partner with the National Center for Missing.

New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain payment transactions that. Cash App also offers. While you cant use it to submit your tax documents IRS2Go does offer many features that simplify the filing process.

Despite what its name may imply you cant submit a report of suspected tax cheating through the IRS fraud hotline. DHS is committed to helping victims feel stable safe and secure. EXECUTIVE SUMMARY THE IRS RELEASED REVENUE PROCEDURE 2000-22 and revenue procedure 2001-10 to give small businesses some much needed guidance on choosing or changing their accounting method for tax purposes.

Be ready to provide your taxpayer identification number eg Employer Identification Number to the cash app so they can report it on Form 1099-K. The new 600 reporting requirement does not apply to personal Cash App accounts. To report suspected human trafficking call the DHS domestic 24-hour toll-free number at 866-DHS-2-ICE 866-347-2423 or 802-872-6199 non-toll-free international.

Squares Cash App includes a partially updated page for users with Cash App for Business accounts.

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Browse Our Image Of Thrift Store Donation Receipt Template Receipt Template Letter Templates Statement Template

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Changes To Cash App Reporting Threshold Paypal Venmo More

Irs Has New Ways Of Taxing Cash App Transactions

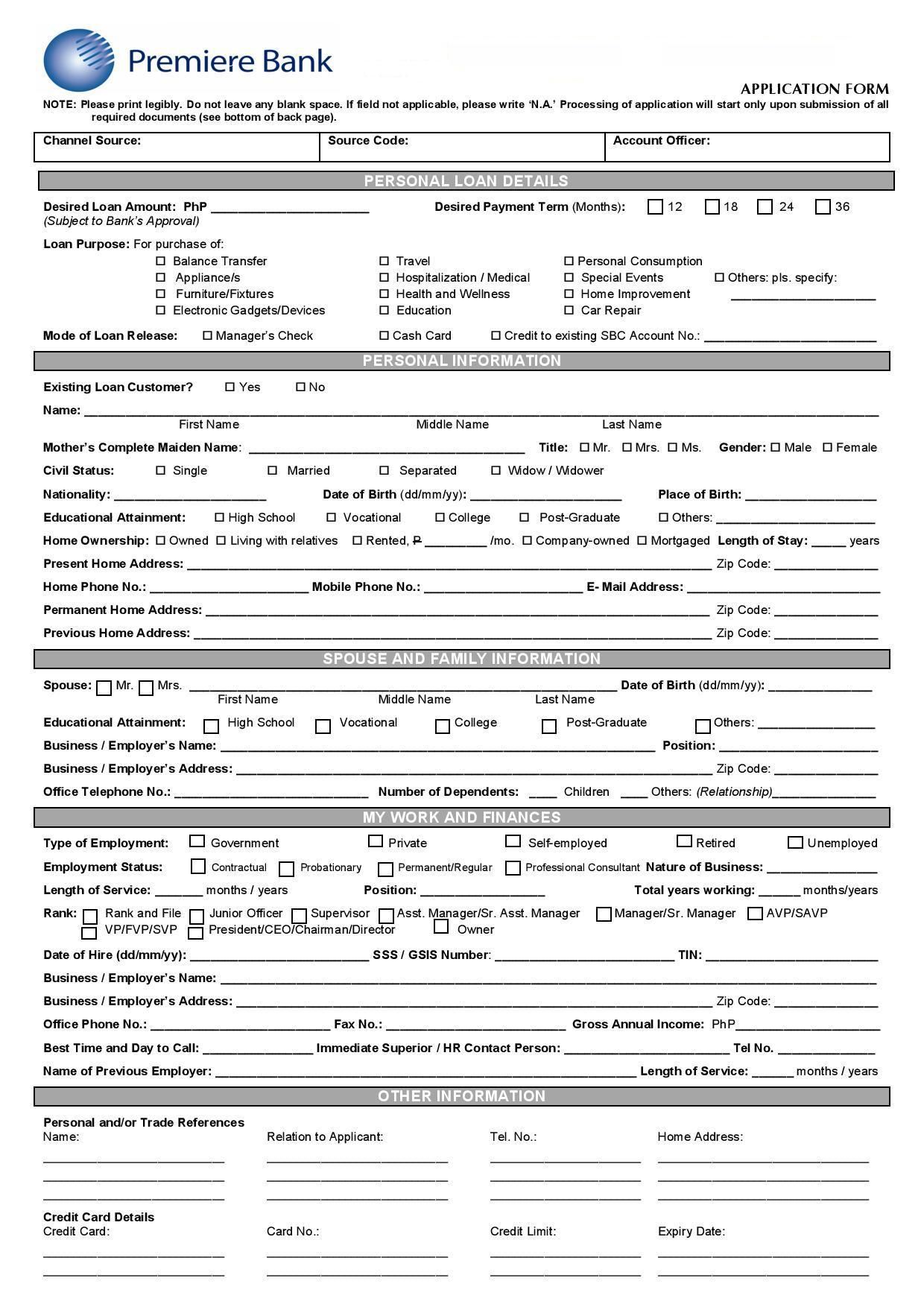

Basic Blank Personal Loan Form They Try To Get A Loan For The Recording Session The Girl Wants To Set Up

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Irs Unleashes Global Fatca Data Exchange Offshore Transparency Everywhere Offshore Finance Blog Accounting

Fillable Form 1040 Individual Income Tax Return Income Tax Tax Return Income Tax Return

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship Best Crypto Tax Software Cryptocurrency

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Changes To Cash App Reporting Threshold Paypal Venmo More

Pin By Dominique Rogers On Organize Life Tax Deductions Property Tax Rental Property

Ir 2022 08 January 10 2022 The Irs Announced That The Nation S Tax Season Will Start On Monday January 24 2022 When The Ta In 2022 Tax Deadline Filing Taxes Irs

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Income Tax

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Organization Solutions

Pin By Jessica Hufford On Money Tax Prep Checklist Tax Checklist Tax Preparation